|

Getting your Trinity Audio player ready...

|

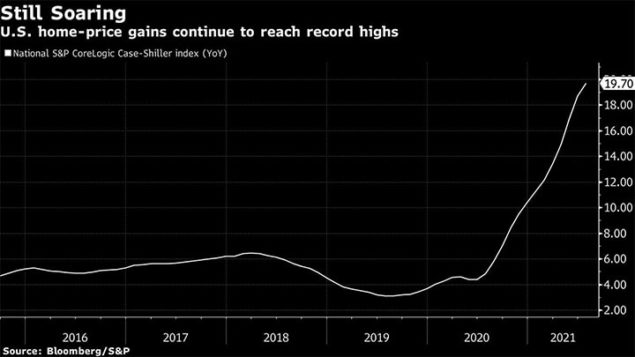

Over the last 12 months, homeowners have been lulled into fantasy land as they read about bidding wars and hear about homes selling for many thousands of dollars more than asking price. Trying to capture some lightning in a bottle, they are becoming sellers thinking they can overprice their property too, but the market is now seeing a trend toward price reductions – 9.9 percent in September, up from 8.6 percent in July.

This Halloween may prove to be downright scary for greedy sellers who are chasing ghosts of months past. Many are setting their prices too high, attempting to get top dollar from buyers who they believe are willing to pay well over the asking price. A growing percentage of those sellers quickly learn that they have to get real. “Approximately 30 percent of all appraisals are now coming in below the Contract price in South Florida,” remarks Phil Spool, a seasoned General Appraiser.

The market can certainly get spooked when, and this is true, almost 25 percent of sellers currently listed have put their homes on the market just to see how much profit they can make (according to a survey from realtor.com). Almost 30 percent said they were going to ask for more than their home was worth. Think about that for a moment. Sellers know they are overpriced and think that is perfectly OK.

The last quarter of 2021 may turn somewhat ghoulish with this unsustainable attitude.

Price cuts are inevitable, especially with the likelihood of interest rate hikes ahead.

Widespread price cuts can be bad for the overall market as they cause buyers to be wary of trying to buy and they might back away. When sellers make price reductions to get them back to the property, they wonder what’s wrong with it.

In general, the market is still hot. The median price in Miami-Dade County is $500,000, a 20 percent increase from last year. Real estate agents call the high prices a “make-me-move” price. Sellers want to see how much money they can make rather than moving out of pure necessity.

The blood-sucking vampires of the last 18-months will soon have their day come. Buyers know when something is overpriced. Until recently, that seemed acceptable. But what goes up must eventually return to the ground.

Finally, the number of homes available for sale should increase. According to realtor.com, you can expect to see more new listings come to market. The findings estimate we’ll see roughly 17.6 percent more homes available than we saw at the start of the year. Yes, Halloween may just end up with the buyers finally clawing back some control.

Rental Arrears Near Breakpoint

More than 1 out of every 10 Miami-Dade County rental households were in arrears as of early August, according to a new county-by-county analysis by Surgo Ventures, a nonprofit organization that uses data to analyze health and social problems in communities. An estimated 85,027 (19.7 percent) rental households are in danger of eviction, despite the availability of extensive government funding for rental assistance.

Delinquent Miami-Dade County households collectively owed $402,926,191 in back rent as of early August, according to Surgo Ventures’ estimates, for an average of $4,823 each.

What goes up, must likely will come down. Meanwhile, real families’ housing hangs in the balance.

Real Estate Update

As of 9/29/21, there were only 69 properties for sale in Pinecrest, 35 homes pending sale and 2.1 months of inventory. This is still a Seller’s market, but not forever! If you’re ready to move, get the best local expertise, truthful guidance and realistic expectations. It’s easy to get started at miamihal.com/getstarted. I invite you to view past episodes of my The MiamiHal Real Estate Show at miamihal.com/the-miamihal-real-estate-show to hear from experts and get the latest real estate news.

Hal Feldman (MiamiHal) is a Realtor with RE/MAX Advance Realty. You can contact him with your story ideas or real estate questions at www.MiamiHal.com, Hal@MiamiHal.com or www.facebook.com/MiamiHal