|

Getting your Trinity Audio player ready...

|

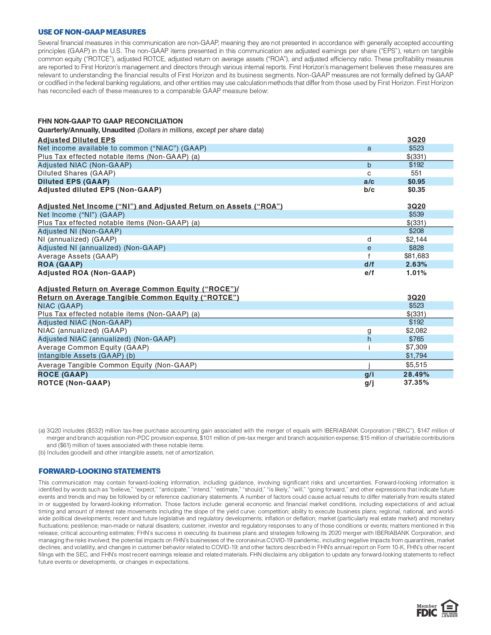

Results include $269 million pre-tax, or $0.60 per share, of notable items largely related to the IBERIABANK merger

Adjusted net income available to common of $193 million or EPS of $0.35*

Reflects strong fee income and continued expense discipline partially offset by the impact of net interest income headwinds and a CECL reserve build of $13 million

ROCE of 28.49%; Adjusted ROTCE of 13.90%*

Tangible book value per share of $9.92 remained relatively stable

First Horizon National Corp. (NYSE: FHN or “First Horizon”) today reported

third quarter 2020 net income available to common shareholders of $523 million, with earnings per share of $0.95. Third quarter 2020 results reflect the impact of the July 1, 2020, IBERIABANK Corporation merger (“IBKC Merger”) and the July 17, 2020, acquisition of 30 Truist branches (“Branch Acquisition”) and include $269 million pre-tax, or $0.60 per share, from notable items largely related to the IBKC Merger. Excluding notable items,

adjusted third quarter net income available to common shareholders totaled $193 million, or $0.35 per share.*

Reported results prior to third quarter 2020 reflect legacy First Horizon results only.

“We achieved major milestones in third quarter 2020 with the completion of our merger of equals with IBERIABANK and the Truist branch acquisition,” said President and Chief Executive Officer Bryan Jordan. “We also delivered strong results despite continued macroeconomic and interest rate headwinds tied to the pandemic, highlighted by strong execution in our counter-cyclical fee income businesses and continued expense discipline.”

Jordan continued, “I am incredibly proud of the hard work and dedication of our associates as they continue to focus on delivering for our clients, communities and shareholders as we bring our two companies together. Our team has been extraordinarily resilient and focused through this year of great change. The benefits of our more diversified product set, enhanced scale, expanded presence in attractive southern markets and client-centric culture provide a strong framework to continue to deliver a superior client experience with enhanced productivity and synergies. The integration is well underway, and I have even more confidence today than when we announced the merger that we are better together and well positioned to deliver for all of our stakeholders.”