|

Getting your Trinity Audio player ready...

|

I’ve been a Bank of America customer for more than 30 years and remember when I could walk into my branch and see familiar faces. In years past, when I had a problem, I spoke to the branch manager who quickly, decisively, and with authority, enacted a solution that proved they valued the customer relationship. Today, Bank of America’s customer-first culture is gone. Now, they are careless and hide behind an organizational chart that is designed to put the customer last and maximize profit.

In early 2023, I used my Bank of America Visa credit card to purchase a real estate lead system. It was a large sum of money and the merchant promised to provide leads, a custom website, continuing education, and marketing over the course of an entire year.

Within just a month, it was clear that this shady company was never going to deliver, so I put in a dispute with Bank of America. At one point, I got an email from the merchant stating they were locking me out of my account and I would no longer hear from them. Indeed, they did just that.

After about four months of providing evidence, including the email described above, I was provided a final refund (in the industry this is known as a chargeback) in the Summer of 2023. At this point, I believed that Bank of America had my back and life went on.

On January 26, 2024, a full five months later, the charge was back on my credit card statement, with no explanation whatsoever. I started making inquiries.

I was told that the merchant had appealed the decision and that the charge was now permanently back on my credit card. Of course, never having received the services, I fought back. Over the next 16 months, I have found Bank of America to be anything but an advocate. I have proof of them lying, burying me in a maze of confusing people to talk to, and, probably most infuriating, I have come to find that Bank of America has reduced the title of branch manager to mean absolutely nothing.

I also discovered that when there is a credit card dispute that doesn’t fit their pre-determined mold of processing, Bank of America becomes a feeble and brainless operation.

I learned a few more lessons, as well. First, merchants who don’t want to do the right thing for its customers never have to fight the dispute directly. They simply hire a third-party “chargeback company” that helps the merchant manage and recover revenue lost to chargebacks, all while they ignore the customer’s attempts of contact completely! Most infuriating, in my case, the chargeback company reported a complete lie about me re-using the system after I got locked out. How is that even possible? Nevertheless, Bank of America believed them and never looked back.

Still, I fought. Another three months, and I only met obfuscation. I learned exactly how Bank of America likes to hide. They will stop emailing you and only make calls after 6pm, so that nothing is ever captured on official records. Even after I specifically requested all communication be in written form, Bank of America kept calling.

Finally, I learned a lot about the finger pointing game. In the latter months, Bank of America spent a lot of time and energy telling me that they were not the decision makers.

It was Visa that was to blame. In turn, I asked several times (and several key people at Bank of America) to give me the contact information for the right person at Visa so I could do my own investigative and recovery work. Eventually, a regional manager personally promised to provide this and, you guessed it, after 6pm an underling called me and gave me a generic number to Visa. Not yet knowing it was a generic number, I called and spent 30 minutes learning that it is, in fact, Bank of America that is responsible and empowered to resolve the dispute.

In recent days, I got connected to a person in the Executive Escalations team at Bank of America. She emailed me, stating “I am your point of contact until this matter is resolved.”

She then told me she would exhaustively investigate my issue and it would take some time. After more than a month of silence, I reached out for an update and still got no reply.

Instead, about a week later, I got a physical letter in the mail. It was clearly a form letter and it had different typefaces and font sizes showing it had been cobbled together.

The month-long investigation result? They apologized that they couldn’t do anything because Bank of America “are required to abide by the rules given to us by Mastercard.”

You heard that right, Bank of America’s most recent conclusion is that Mastercard is to blame for my credit card dispute with Visa.

Keep this in mind if you are already a Bank of America customer or might consider Bank of America in the future. This bank is NOT your advocate, NOT professional, and is a ghost of its former self.

In my real estate work, I work for my customers, am communicative and transparent, and have my customer’s best interests in mind at all times. Shouldn’t my bank be doing the same?

Real Estate Update

As of 4/9/25, there were 187 properties for sale in Pinecrest, 20 homes pending sale and 9.4 months of inventory (buyer’s market). If you’re ready to move, contact me to get the best local expertise, truthful guidance and realistic expectations. It’s easy to get started at miamihal.com/getstarted.

I invite you to view past episodes of my The MiamiHal Real Estate Show at miamihal.com/the-miamihal-real-estate-show to hear from experts and get the latest real estate news.

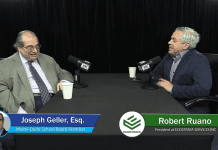

Hal Feldman (MiamiHal) is a Realtor with RE/MAX Advance Realty. You can contact him with your story ideas or real estate questions at www.MiamiHal.com, Hal@MiamiHal.com or www.facebook.com/MiamiHal

ABOUT US:

For more Miami community news, look no further than Miami Community Newspapers. This Miami online group of newspapers covers a variety of topics about the local community and beyond. Miami’s Community Newspapers offers daily news, online resources, podcasts and other multimedia content to keep readers informed. With topics ranging from local news to community events, Miami’s Community Newspapers is the ideal source for staying up to date with the latest news and happenings in the area.

This family-owned media company publishes more than a dozen neighborhood publications, magazines, special sections on their websites, newsletters, as well as distributing them in print throughout Miami Dade County from Aventura, Sunny Isles Beach, Miami Beach, Coral Gables, Brickell, Coconut Grove, Pinecrest, South Miami, Kendall, Palmetto Bay, Cutler Bay and Homestead. Each online publication and print editions provide comprehensive coverage of local news, events, business updates, lifestyle features, and local initiatives within its respective community.

Additionally, the newspaper has exclusive Miami community podcasts, providing listeners with an in-depth look into Miami’s culture. Whether you’re looking for local Miami news, or podcasts, Miami’s Community Newspapers has you covered. For more information, be sure to check out: https://communitynewspapers.com.

If you have any questions, feel free to email Michael@communitynewspapers.com or Grant@communitynewspapers.com.