|

Getting your Trinity Audio player ready...

|

We all got sick. As the world entered the pandemic, our sense of normalcy was shrouded and shredded by false positives, odd runs on toilet paper, and people making breads, soups and gourmet meals at home. Gas briefly dropped to $1.50/gallon. Peloton stock was up 500 percent. That’s not where we are now. In less than 60 days, our view of what has value has taken a sharp turn towards reality.

During the incredible real estate run up, it seemed no one was looking to history to understand our future. While major brokers, agents and respected market makers touted this bull would still run, I said otherwise. Sadly, my prediction was drastically right.

As we enter the normally hot month of June, South Florida seems to be freezing. The market is icy for sellers and buyers. And, although no one can blame one particular thing (Fed monetary policy, Ukraine, inflation, inventory, fear, labor markets, etc.), I will illustrate clearly why most middle-class real estate markets are now feeling more like molasses than lightning.

Most homebuyers need to finance their purchase. It comes down to buying power and people’s ability to methodically afford their monthly mortgage payment. Well, unfortunately in the last 45 days, reality has rung the bell. And most people cannot continue their quest for home ownership. In short, they just can’t afford it.

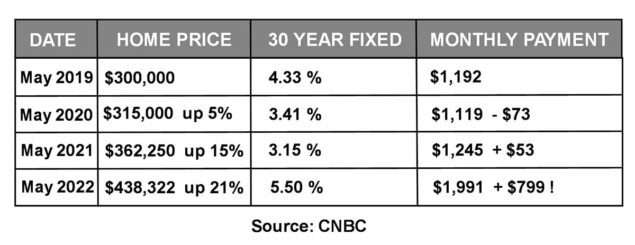

Here is a real-world example of how the skyrocketing home prices and varied interest rates played out before, during and as we exit the pandemic:

(CHART)

Between the rise in home price and the varying interest rate, buying power basically stayed the same until just recently. And, WOW! You can start to see why the buyers have dried up. And this was using a $300,000 purchase as an example. Imagine the pain most buyers are going through in South Florida where the average price is more like $600,000.

With the dust still thick in the air, where do we go from here? I continue to predict a 10 percent drop in the average South Florida home. However, I am now expecting this adjustment to happen like a whiplash. From there, we will see strange volatility in pricing, both above and below the 10 percent prediction, but ultimately settling there at the end of the calendar year.

How can sellers and buyers navigate these changes? By using your local real estate expert who lives the journey every single day. I have helped 47 families so far this year.

Just One More Thing… (Hurricanes)

Usually, when you hear this, it evokes memories of Steve Jobs about to announce something magical at an Apple press conference. This “just one more thing” is likely to curl your toes.

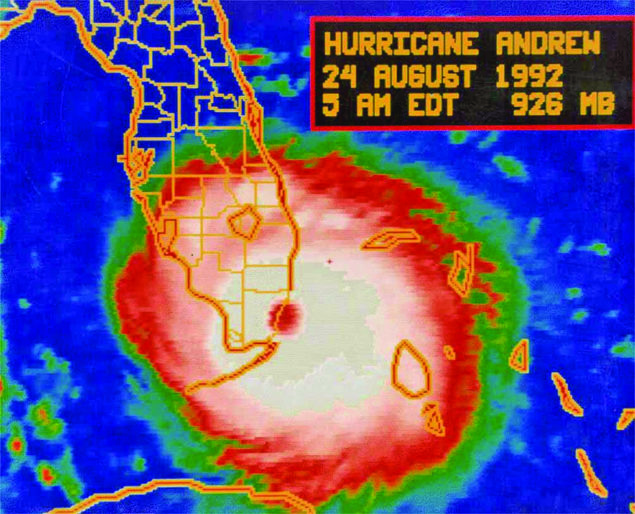

Wed, Jun 1, 2022 through Wed, Nov 30, 2022 is hurricane season. We South Floridians know how to deal with hurricanes. You prepare and usually get to exhale. For the 2022 hurricane season, NOAA is forecasting a likely range of 14 to 21 named storms (winds of 39 mph or higher), of which 6 to 10 could become hurricanes (winds of 74 mph or higher), including 3 to 6 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher). NOAA provides these ranges with a 70 percent confidence.

My concern isn’t necessarily local. It is how a hurricane season can affect the real estate market, especially when we are already hypersensitive. We already know that a good deal of the rise in prices of our real estate was due to an influx of people from the New York metro and California. What happens when they see a storm or three roll through South Florida in a market that is already cooling? I’d say you might just get a perfect storm.

Hurricanes are not only physically destructive, they are psychological. We shall see if the winds of change hit us hard this year. Please make sure you have your windstorm insurance in place and are ready. This year, above others, may be very stormy in more ways than one.

Real Estate Update

As of 5/27/22, there were 78 properties for sale in Pinecrest, 38 homes pending sale and 2.4 months of inventory. If you’re ready to move, get the best local expertise, truthful guidance and realistic expectations. It’s easy to get started at miamihal.com/getstarted.

I invite you to view past episodes of my The MiamiHal Real Estate Show at miamihal.com/the-miamihal-real-estate-show to hear from experts and get the latest real estate news.

Hal Feldman (MiamiHal) is a Realtor with RE/MAX Advance Realty. You can contact him with your story ideas or real estate questions at www.MiamiHal.com, Hal@MiamiHal.com or www.facebook.com/MiamiHal