|

Getting your Trinity Audio player ready...

|

Florida’s property insurance crisis is worsening despite recent legislative efforts. The cost of property insurance with windstorm coverage has significantly increased, and coverage amounts have been reduced. As a result, many property owners are choosing to forgo windstorm coverage, which puts their financial well-being at risk, especially with the 2023 hurricane season now upon us.

Over the last several months, I have witnessed numerous instances where both home and business owners have experienced significant decreases in coverage and substantial increases in property insurance renewal costs, particularly for policies with windstorm protection. Notably, two retired couples saw their homeowners’ premiums rise by 50 percent to 200 percent, which they had not anticipated in their retirement plans. Both opted not to renew their policies. On the commercial side, one client’s renewal on their Miami warehouses saw a 70 percent reduction in coverage amount while the premium was increased by more than 200 percent. The client opted not to renew the windstorm portion of coverage to which their lender reluctantly agreed. In talking to many other insurance agents and underwriters in our market, these examples are becoming the norm rather than the exception.

Why is this happening? The issues of natural disasters, litigation, reinsurance capacity, fraud and population growth have converged to create a supply and demand issue. Insurance carriers are reducing their capacity and exposure to Florida while the population and related homes, buildings, and infrastructure increase. A sizable number of insurance carriers believe taking on more Florida exposure could result in losses that have the potential to put them out of business. Per a June 9, 2023, article in the Insurance Journal, “in the past 13 months, 7 out of 47 local property insurance businesses have gone under and another 24 are now on a regulatory watch list.” A majority of carriers that remain in the market have set a ceiling on Florida exposure. Many have hit that ceiling. Basic economics mandates that when demand exceeds supply, prices go up.

Weather-related natural disasters are increasing in severity across the nation. This past December saw severe drops in temperature that resulted in water pipe burst claims from twenty states in one day, with Georgia, in the Deep South having the most. Tornados in the Midwest and South have become stronger and more devastating. California, always known for its wildfires, has had record floods this year. These events impact risks and premiums on property insurance. Per the American Property and Casualty Insurance Association, natural-disaster losses from 2020-2022 in the U.S. resulted in a record $275 Billion in insured damages. Florida, surrounded by water and prone to hurricanes, is near the top of the risk spectrum for insurance carriers.

All the above creates a looming financial crisis. Because of availability and cost factors, many Florida property owners are either underinsured or not insured at all for windstorm damage. It is logical to assume that if these property owners cannot afford high insurance premiums, they will almost certainly be devastated financially if they incur major damage to their homes and buildings. This not only affects our state’s many retirees and small businesses, but also the financial institutions which have loans on these properties. Our community will suffer financially.

We need more insurance capacity at reasonable pricing. Arriving at the solution will not be easy. Property insurance is a complex industry with many stakeholders to satisfy—insurers, property owners, reinsurers, agents, attorneys, consumer advocates, elected officials, voters, etc. Additionally, some issues may need to be addressed on a federal level rather than at the state level.

Hope is not an ideal strategy but given current circumstances, more than ever, we hope that Florida avoids being hit by a hurricane this season. If large U.S. populations can avoid a major storm in 2023, perhaps with the capital saved by carriers and the recent Florida legislative acts, next year will be a better year for our state’s insurance market. However, if major damages are incurred again this year, we may very well be on the path to a federal taxpayer bailout – a less than desirable outcome at best.

Doug Sawyer, a Miami-born financial professional, has held various executive level positions in banking, investments and insurance. Presently, he is affiliated with Century Risk Advisors, a risk advisory and insurance firm based in South Florida. Committed to community engagement, Doug is a member of the Greater Miami Chamber’s Finance Committee and the Board of the South Florida Banking Institute. Additionally, he previously served as Chairman of the Board for Christopher Columbus High School.

ABOUT US:

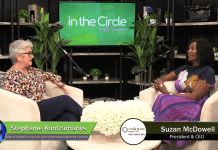

For more Miami community news, look no further than Miami Community Newspapers. This Miami online group of newspapers covers a variety of topics about the local community and beyond. Miami’s Community Newspapers offers daily news, online resources, podcasts and other multimedia content to keep readers informed. With topics ranging from local news to community events, Miami’s Community Newspapers is the ideal source for staying up to date with the latest news and happenings in the area. Additionally, the newspaper has exclusive Miami community podcasts, providing listeners with an in-depth look into Miami’s culture. Whether you’re looking for local Miami news, or podcasts about the community, Miami’s Community Newspapers has you covered.