Much of Miami-Dade County’s projects are funded through bond issuance. Essentially the County takes on debt by pledging future money to receive present-day funding.

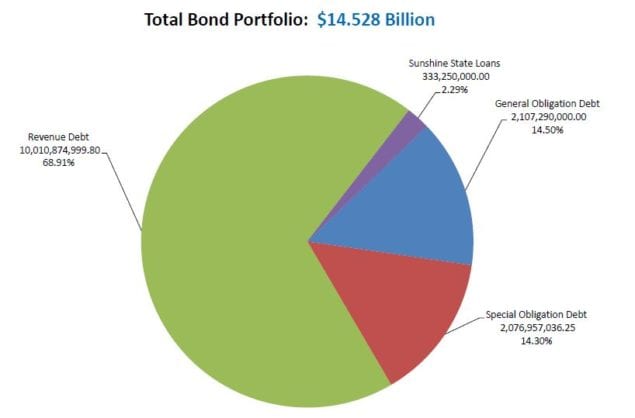

The County currently has close to $15 billion in debt through various forms of bond issuance. The three largest pools of debt consist of Revenue debt, General Obligation debt, and Special Obligation debt, with Revenue debt being by far the largest pool at over $10 billion. A simple way to look at the idea and purpose of bonds is to think of a car loan. If people were expected to pay for a home or car out of their own liquid assets, very few people would be able to afford these amenities. Instead, we borrow money from the bank and pledge our future earnings to pay back the lump sum that the bank gives us to make big purchases.

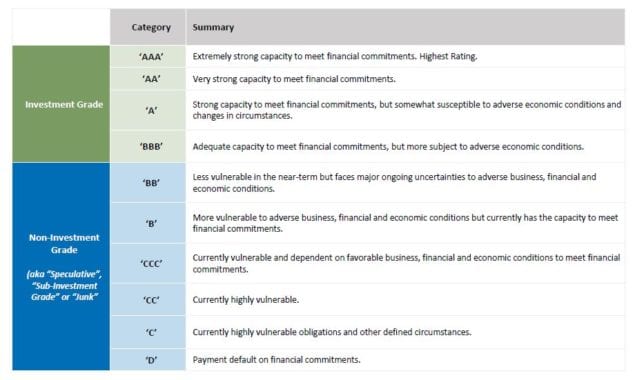

The County is not necessarily buying a house or a car but it does have large infrastructure projects costing millions of dollars and thus the need for capital is the same. Just as our financial situations, represented by credit ratings, dictate the interest rate that banks will give us on loans, the County’s financial health affects the interest rate on bonds. The large lending firms like Moody’s, Fitch, S&P, and Kroll, will rate prospective borrowers on a scale from ‘AAA’ down to ‘D’ with ‘AAA’ being the highest possible rating and ‘D’ being the lowest. A borrower with an ‘AAA’ credit rating will receive a lower interest rate on their loan than a ‘D’-rated borrower.

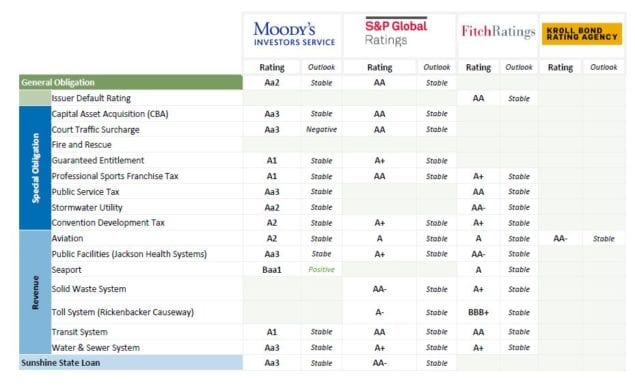

The County has different credit ratings depending on the bond category. Different enterprises have different credit ratings depending on the nature of their revenue and their history of earnings and repayment. In general though the County is almost entirely rated in the A categories and thus receives favorable interest rates when seeking loans.

Revenue Bonds

Revenue bonds are supported by enterprise department revenue streams. Departments like Water and Sewer, Aviation, Solid Waste, and Transit have operations that generate revenue through fee-based services and will pledge these future revenues to receive funding for present-day projects.

Aviation, for example, has used debt issuance funding to pay for the construction of facilities at Miami International Airport such as the MIA Mover Program and the North Terminal Program. Solid Waste uses this form of funding for closure of landfills, construction of new landfills, and transfer station improvements.

General Obligation Bonds

General Obligation bonds require voter approval and are secured by ad valorem tax revenue, meaning real estate taxes. The largest such bond is the Building Better Communities Bond. Voters approved a total amount of $2.9 billion in 2004 for this bond and the current amount outstanding is just over $1.7 billion.

Funds from the Building Better Communities bond have been used, since 2004, on drainage and sewer improvement projects all over District 7. Public amenities like Crandon Park Beach have seen improvements to recreation centers and restroom facilities through Building Better Communities funds.

Bike trails like the Metro-rail trail, the Ludlam bike trail, and the Commodore trail in Coconut Grove have all received improvements thanks to this funding. If you enjoy fishing off of the Rickenbacker fishing pier, Building Better Communities funding has rehabilitated your fishing spot. The Crandon Park fire station and the Coral Gables police station have been able to implement rehabilitative projects as a result of General Obligation funds.

Perhaps the most impactful project to have benefited from General Obligation funds is the Gibson Plaza Community Center in Coconut Grove that received $9 million worth of General Obligation funding. Through this project we added much-needed affordable housing for seniors in our community.

Special Obligation Bonds

The third substantial bond issuance is in the form of Special Obligation bonds. These bonds carry an outstanding amount of $2.1 billion. Special Obligation bonds are secured by various revenue streams from different taxes and surcharges. The largest item funded through these bonds is the Convention Development Tax at just under $1 billion and used to fund projects like the Miami Arena, Frost Museum, and the Performing Arts Center.

Another substantial Special Obligation debt is the Pro Sports Franchise Facility Tax at just under $300 million used to fund professional sports facilities such as Marlins Park.

Miami-Dade County Commissioner Xavier L. Suarez can be reached at 305-669-4003 or via email at district7@miamidade.gov.