As part of the Families First Coronavirus Response Act signed into law by President Trump on March 18, 2020, two laws were enacted that provide workers with paid leave for reasons related to the coronavirus (COVID-19) pandemic. One of the new leave laws, the Emergency Family and Medical Leave Expansion Act, allows 12 weeks of partially compensated FMLA leave to care for a child whose school or child care facility has been closed due to COVID-19. The leave applies only to workers who have been employed by their current employer for 30 days.

The other new law providing employee leave, the Emergency Paid Sick Leave Act, requires employers to provide 80 hours of paid sick time to employees in specified circumstances, including:

✓ A quarantine or isolation order for the employee or someone the employee is caring for, or medical advice to self-quarantine;

✓ When the employee has symptoms of COVID-19; or

✓ When the employee’s child’s school or child care facility is closed.

Employers with 500 employees or more are exempt from the laws, and employers may exclude employees who are health care providers and emergency responders. The legislation also allows for future regulations exempting businesses with fewer than 50 employees from providing leave for child care reasons if the leave would jeopardize the viability of the business. The leave benefits take effect on April 1, 2020, and expire on Dec. 31, 2020.

Overview

To alleviate the effects of the coronavirus (COVID-19) pandemic, Congress enacted the Families First Coronavirus Response Act, which included two separate laws mandating paid employee leave for specific COVID-19 purposes. The two leave laws are the Emergency Family and Medical Leave Expansion Act and the Emergency Paid Sick Leave Act. The leave mandates take effect on April 1, 2020 and sunset on Dec. 31, 2020.

The Emergency Family and Medical Leave Expansion Act

In general, the Emergency Family and Medical Leave Expansion Act amends the federal Family and Medical Leave Act (FMLA) to allow employees to take leave for certain child care purposes related to COVID-19. It requires employers to partially compensate that leave after the first 10 days.

Covered Employers

The expanded FMLA requirements apply to private employers with fewer than 500 employees, and some government employers. Thus, small employers that are not subject to the FMLA’s regular leave provisions are subject to the new FMLA leave rules that allow employees to take leave for specified child care purposes related to COVID-19.

However, the law allows for future regulations to exempt businesses with fewer than 50 employees if the leave would jeopardize the viability of the business. The DOL has issued guidance stating that a small business may claim this exemption if an authorized officer of the business has determined that:

✓ The provision of expanded family and medical leave would result in the small business’s expenses and financial obligations exceeding available business revenues and cause the small business to cease operating at a minimal capacity;

✓ The absence of the employee or employees requesting expanded family and medical leave would entail a substantial risk to the financial health of operational capabilities of the small business because of their specialized skills, knowledge of the business, or responsibilities; or

✓ There are not sufficient workers who are able, willing, and qualified, and who will be available at the time and place needed, to perform the labor or services provided by the employee or employees requesting expanded family and medical leave, and these labor or services are needed for the small business to operate at a minimal capacity.

The law further stipulates that employers with fewer than 50 employees will not be subject to civil damages in an employee action brought under the FMLA for violation of the new provisions.

Covered Employees

All employees who have worked for their current employer for 30 calendar days are eligible for the new FMLA leave; however, employers are permitted to deny leave to employees who are health care providers or emergency responders.

DOL Q&As on the new laws state that a health care provider is anyone employed at any doctor’s office, hospital, health care center, clinic, post-secondary educational institution offering health care instruction, medical school, local health department or agency, nursing facility, retirement facility, nursing home, home health care provider, any facility that performs laboratory or medical testing, pharmacy, or any similar institution, employer, or entity. This includes any permanent or temporary institution, facility, location, or site where medical services are provided that are similar to such institutions.

The DOL guidance explains further that the definition includes any individual employed by an entity that contracts with any of the above institutions, employers, or entities to provide services or maintain the operation of the facility. It also includes anyone employed by any entity that provides medical services, produces medical products, or is otherwise involved in the making of COVID-19-related medical equipment, tests, drugs, vaccines, diagnostic vehicles, or treatments. This also includes any individual that the highest official of a state or territory, including the District of Columbia, determines is a health care provider necessary for that state’s or territory’s—or the District of Columbia’s—response to COVID-19.

To minimize the spread of the virus associated with COVID-19, DOL encourages employers to be judicious when using this definition to exempt health care providers from the provisions of the FFCRA.

Most public federal employees are not covered by the FMLA expansion because the law amended only Title I of the FMLA, and most federal employees are covered by Title II. However, most non-federal employees of public agencies are covered by the expanded FMLA leave. The health care provider and emergency responder exemptions described above also apply to public-sector employees.

Using Leave

Eligible employees of covered employers may take up to 12 weeks of FMLA leave if they are unable to work (or telework) because they must care for a son or daughter under 18 years of age. The need for leave must be caused by the closing of the child’s elementary or high school or place of care, or the unavailability of the child’s child care provider, due to a declared COVID-19 public health emergency.

DOL Q&As clarify that “son or daughter” means the employee’s own child, including a biological, adopted, or foster child; a stepchild; a legal ward; or a child for whom the employee is standing in loco parentis—someone with day-to-day responsibilities to care for or financially support a child. Adult children are included if they have a disability that renders them incapable of self care.

“Child care provider” means a provider who receives compensation for providing child care services on a regular basis.

DOL Q&As on the new laws explain that if an employer was covered by the FMLA before April 1, 2020, an employee is limited to 12 weeks of total FMLA leave (including expanded FMLA leave) during the 12-month period the employer uses for FMLA leave.

Where the need for leave is foreseeable, employees should provide their employers with as much notice of leave as is practicable.

Compensation

Employers are not required to pay employees for the first 10 days of the new FMLA leave, but employees may substitute any accrued vacation leave, personal leave, or medical or sick leave for this unpaid leave. Thereafter, the employer must compensate FMLA leave taken under the new provision at a rate of at least two-thirds of the employee’s regular rate of pay, based on the number of hours the employee would otherwise normally be scheduled to work, up to a maximum of $200 per day, or $10,000 total.

Special calculation rules apply for employees with variable schedules, and special rules apply to multi-employer collective bargaining agreements.

Job Protection

While FMLA leave is usually job-protected, meaning employees who take leave must be restored to their position (or an equivalent) when they return to work, the new law provides a limited exception to this requirement. Employers with fewer than 25 employees are not subject to the job restoration requirement, if:The employee took FMLA leave under the new COVID-19 expansion of the law;

X The employee’s position no longer exists due to economic conditions or changes in operating conditions of the employer that affect employment and are caused by a public health emergency;

X The employer makes reasonable efforts to restore the employee to an equivalent position; and

X If these efforts fail, the employer makes reasonable efforts to contact the employee if an equivalent position becomes available. The contact period is for one year, beginning on the earlier of:

- The date on which the employee’s need for leave ends

- Twelve weeks after the employee’s leave begins

In addition, DOL Q&As on the new law state that employers who can demonstrate that an employee would have been laid off regardless of taking leave are exempt from the job restoration requirement. The Q&As give closure of the worksite as an example of this exemption. Highly compensated “key employees,” as defined under the FMLA, are also exempt from the protection of the job restoration requirement.

Tax Credit

Employers are entitled to a credit against the tax imposed by section 3111(a) or 3221(a) of the IRS Code for each calendar quarter of an amount equal to 100% of qualified family leave wages paid. Tax credits are also available for self-employed people.

Emergency Paid Sick Leave Act

The second federal law passed providing paid employee leave in relation to the coronavirus is the Emergency Paid Sick Leave Act.

Covered Employers

The paid sick leave law applies to all private employers with fewer than 500 employees, and all government employers. The law allows for future regulations exempting businesses with fewer than 50 employees from providing leave for specific child care reasons under certain conditions, described later in this document in the Using Paid Sick Leave section.

Covered Employees

All employees are covered by the Emergency Paid Sick Leave Act, regardless of the length of their employment with their current employer. However, as with the expanded FMLA leave, employers may choose not to provide paid sick leave to employees who are health care providers or emergency responders. As with the exemption to expanded FMLA leave, DOL Q&As define these workers as anyone employed at any doctor’s office, hospital, health care center, clinic, post-secondary educational institution offering health care instruction, medical school, local health department or agency, nursing facility, retirement facility, nursing home, home health care provider, any facility that performs laboratory or medical testing, pharmacy, or any similar institution, employer, or entity. This includes any permanent or temporary institution, facility, location, or site where medical services are provided that are similar to such institutions.

The definition also includes any individual employed by an entity that contracts with any of the above institutions, employers, or entities to provide services or maintain the operation of the facility. It also includes anyone employed by any entity that provides medical services, produces medical products, or is otherwise involved in the making of COVID-19-related medical equipment, tests, drugs, vaccines, diagnostic vehicles, or treatments. This also includes any individual that the highest official of a state or territory, including the District of Columbia, determines is a health care provider necessary for that state’s or territory’s—or the District of Columbia’s—response to COVID-19.

DOL encourages employers to be judicious using this definition to exempt health care providers from the provisions of the law.

Most government employees are covered by the Emergency Paid Sick Leave Act.

Using Paid Sick Leave

All full-time employees (normally scheduled to work 40 or more hours per week), are entitled to 80 hours of paid sick time, available for immediate use, regardless of the length of time they have worked for their employer. Part-time employees (normally scheduled to work fewer than 40 hours per week) are entitled to an amount of paid sick time equal to the average number of hours they work over a two-week period.

Paid sick time may be taken when the employee:

- Is subject to a federal, state or local quarantine or isolation order related to COVID-19

- Has been advised by a health care provider to self-quarantine due to concerns related to COVID-19

- Is experiencing symptoms of COVID-19 and is seeking a medical diagnosis

- Is caring for an individual who is subject to a federal, state or local quarantine or isolation order related to COVID-19, or who has been advised by a health care provider to self-quarantine

- Is caring for his or her son or daughter if the child’s school or place of care has closed, or the child’s care provider is unavailable, because of COVID-19 precautions

- Is experiencing another substantially similar condition specified by the Secretary of Health and Human Services (HHS)

DOL Q&As clarify that “son or daughter” means the employee’s own child, including a biological, adopted, or foster child; a stepchild; a legal ward; or a child for whom the employee is standing in loco parentis. Children 18 or over are included if they have a disability that renders them incapable of self care.

The law allows for future regulations exempting businesses with fewer than 50employees from providing leave related to school or child care unavailability (reason 5, above), if the leave would jeopardize the viability of the business as a going concern. According to DOL guidance, the exemption may be claimed if an authorized officer of the business has determined that one of the following conditions is satisfied:

✓ The provision of paid sick leave would result in the small business’s expenses and financial obligations exceeding available business revenues and cause the small business to cease operating at a minimal capacity;

✓ The absence of the employee or employees requesting paid sick leave would entail a substantial risk to the financial health or operational capabilities of the small business because of their specialized skills, knowledge of the business, or responsibilities; or

✓ There are not sufficient workers who are able, willing, and qualified, and who will be available at the time and place needed, to perform the labor or services provided by the employee or employees requesting paid sick leave, and these labor or services are needed for the small business to operate at a minimal capacity.

Employers may not require employees to use other paid leave before using paid leave under the new law; however, an employer may require an employee to follow reasonable notice procedures after taking leave for the first time.

Compensation

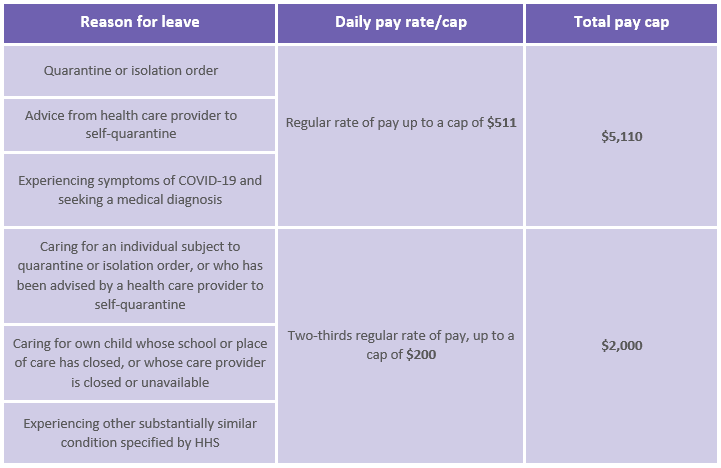

Employee compensation under the Emergency Paid Sick Leave Act varies according to the reason for the leave, as set forth in the table below:

Special calculation rules apply for part-time employees with variable work schedules.

Employer Notice Requirements

Employers must post this notice in conspicuous places on their premises, where notices to employees are customarily posted. An employer may satisfy this requirement by emailing or direct mailing this notice to employees, or posting the notice on an employee information internal or external website.

Enforcement

Employers who violate the new paid sick leave law will be subject to penalties under the federal Fair Labor Standards Act. The DOL has issued guidance saying it will not bring enforcement actions against any employer for violations of either leave provision in the Families First Coronavirus Response Act occurring within the first 30 days after it was passed (March 18 through April 17, 2020). This reprieve from enforcement only applies if the employer has made reasonable, good faith efforts to comply with the Act.

Tax Credit

Employers are entitled to a credit against the tax imposed by section 3111(a) or 3221(a) of the IRS Code for each calendar quarter, of an amount equal to 100% of qualified sick leave wages paid. Tax credits are also available for the self-employed.

As has been the case since 1950, the professional agents and underwriters at Morris & Reynolds Insurance are happy to help you. Whether you have a question about this topic or need help with any form of insurance, please contact us at any time at 305.238.1000.